Offering Details

Back

Current Offerings / KSV Restructuring Inc.

Independent Renewable Resources Corp.

KSV Restructuring Inc.

Independent Renewable Resources Corp.

Receivership Sale

Receivership SaleBid Deadline: February 26, 2026

12:00 PM

Download Full PDF - Printable

OVERVIEW

On November 13, 2025, the Court of King’s Bench of Alberta granted an order pursuant to the Bankruptcy and Insolvency Act, appointing KSV Restructuring Inc. (“KSV”) as the receiver and manager (the “Receiver”) over all the current and future assets, undertakings, and properties (collectively, the “Property”) of Independent Renewable Resources Corp. (“IRRC”) and Independent Energy Holdings Inc. (“IEHI”, and collectively, the “Companies”).

On January 15, 2026, the Receiver obtained an order, among other things, approving a sale process (the “Sale Process”) and the Receiver’s engagement of Sayer Energy Advisors as the sales agent in the Sale Process. The Sale Process is intended to solicit interest in a sale of the Property, including IRRC’s used motor oil (“UMO”) feedstock modular refinery (the “Echo Refinery”) located on 49.39 acres of land in the Regional Municipality of Bone Creek No. 108, in southwest Saskatchewan (the “Lands”).

The Sale Process procedures, including the relevant milestones, are available on the Receiver’s case website at: www.ksvadvisory.com/experience/case/IRRC. Production volume summary information and further details on the Property will be available in the virtual data room for parties that execute a non-disclosure agreement.

On January 15, 2026, the Receiver obtained an order, among other things, approving a sale process (the “Sale Process”) and the Receiver’s engagement of Sayer Energy Advisors as the sales agent in the Sale Process. The Sale Process is intended to solicit interest in a sale of the Property, including IRRC’s used motor oil (“UMO”) feedstock modular refinery (the “Echo Refinery”) located on 49.39 acres of land in the Regional Municipality of Bone Creek No. 108, in southwest Saskatchewan (the “Lands”).

The Sale Process procedures, including the relevant milestones, are available on the Receiver’s case website at: www.ksvadvisory.com/experience/case/IRRC. Production volume summary information and further details on the Property will be available in the virtual data room for parties that execute a non-disclosure agreement.

ECHO REFINERY

Township 9, Range 17 W3

The Echo Refinery facility is a UMO feedstock refinery that produces distillate, naphtha, gasoline, kerosene, and bunker residuals. The Echo Refinery is located at 11-08-009-17W3 in the rural municipality of Bone Creek, near Instow, Saskatchewan. The Echo Refinery was constructed by Echo Refinery Ltd. in 2018.

The Echo Refinery relies on feedstock supplied by several large waste management and recycling companies. Feedstock suppliers include Environmental 360 Solutions, Recycle West Inc., and GFL Environmental Services Inc.

IRRC is the main operating entity through its ownership and operation of the Echo Refinery.

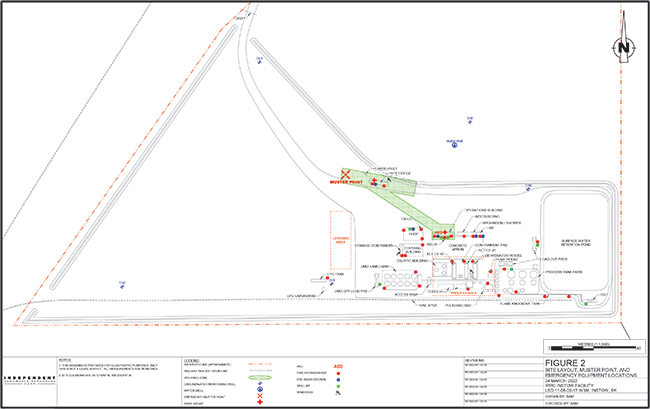

The Lands consist of 49.39 acres. The Echo Refinery is comprised of a 20-hectare gated property with an earthen perimeter berm. Facility operations are primarily limited to a 2.3-hectare area within the southeast portion of the Lands. Shipping modes include bulk liquid tankers, vacuum trucks and rail.

The Echo Refinery facility is a UMO feedstock refinery that produces distillate, naphtha, gasoline, kerosene, and bunker residuals. The Echo Refinery is located at 11-08-009-17W3 in the rural municipality of Bone Creek, near Instow, Saskatchewan. The Echo Refinery was constructed by Echo Refinery Ltd. in 2018.

The Echo Refinery relies on feedstock supplied by several large waste management and recycling companies. Feedstock suppliers include Environmental 360 Solutions, Recycle West Inc., and GFL Environmental Services Inc.

IRRC is the main operating entity through its ownership and operation of the Echo Refinery.

The Lands consist of 49.39 acres. The Echo Refinery is comprised of a 20-hectare gated property with an earthen perimeter berm. Facility operations are primarily limited to a 2.3-hectare area within the southeast portion of the Lands. Shipping modes include bulk liquid tankers, vacuum trucks and rail.

Ownership

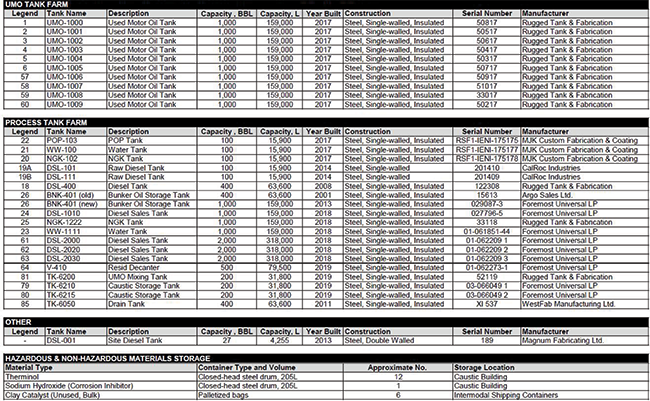

Echo Refinery’s operations include the UMO processing plant, UMO inlet tank farm, processing/sales tank farm and a surface water retention pond located adjacent to the eastern berm.

All systems associated within the UMO processing plant are computer controlled from the motor control centre building. Operation and monitoring of processing equipment can also be conducted remotely from an off-site device through a secured connection.

Echo Refinery’s operations include the UMO processing plant, UMO inlet tank farm, processing/sales tank farm and a surface water retention pond located adjacent to the eastern berm.

All systems associated within the UMO processing plant are computer controlled from the motor control centre building. Operation and monitoring of processing equipment can also be conducted remotely from an off-site device through a secured connection.

Echo Refinery Overview

The Echo Refinery includes the following primary buildings and infrastructure onsite:

• Shop

• Cold storage Coverall building

• UMO tank farm

• Process tank farm

• Process area equipment

• Single track rail spur

• Water supply well and building

• Natural gas supply

• Operations, motor control centre, wash car, and lab buildings (modular)

• Chemical building with tanks

• Dehydrator and process kettles

• Combustor

• Concrete apron in process area and concrete loading pads

• Intermodal shipping container storage

• Power supply and transformer

The modular buildings, kettles, and process equipment are mounted on piles. Both tank farms have lined steel containment rings with concrete pads.

The Echo Refinery is surrounded by an earthen berm comprised of topsoil stripped from the yard. An existing groundwater monitoring network consisting of five monitoring wells is in place on the Lands.

Above Ground Storage Tank Summary

The Echo Refinery includes the following primary buildings and infrastructure onsite:

• Shop

• Cold storage Coverall building

• UMO tank farm

• Process tank farm

• Process area equipment

• Single track rail spur

• Water supply well and building

• Natural gas supply

• Operations, motor control centre, wash car, and lab buildings (modular)

• Chemical building with tanks

• Dehydrator and process kettles

• Combustor

• Concrete apron in process area and concrete loading pads

• Intermodal shipping container storage

• Power supply and transformer

The modular buildings, kettles, and process equipment are mounted on piles. Both tank farms have lined steel containment rings with concrete pads.

The Echo Refinery is surrounded by an earthen berm comprised of topsoil stripped from the yard. An existing groundwater monitoring network consisting of five monitoring wells is in place on the Lands.

Above Ground Storage Tank Summary

Liability Assessment

In a decommissioning and reclamation plan accepted by the Saskatchewan Ministry of Environment in 2024, the total estimated decommissioning value for the Property was $242,564. The next submission is not required until April 30, 2029.

In a decommissioning and reclamation plan accepted by the Saskatchewan Ministry of Environment in 2024, the total estimated decommissioning value for the Property was $242,564. The next submission is not required until April 30, 2029.

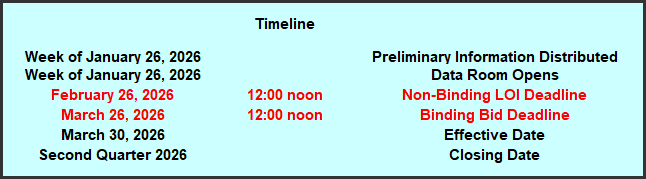

PROCESS & TIMELINE

Sayer Energy Advisors is accepting letters of intent ("LOIs") relating to the Sale Process until 12:00 pm on Thursday February 26, 2026.

Sayer Energy Advisors does not typically conduct a "second-round" bidding process; the intention is to attempt to conclude a

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process,

subject to the terms outlined in the Sale Process procedures.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process,

subject to the terms outlined in the Sale Process procedures.

Sayer Energy Advisors is accepting LOIs relating to the Sale Process,

from interested parties until noon on Thursday February 26, 2026.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Property with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed information relating to this opportunity should execute the Non Disclosure Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: agreement and key contracts, most recent production volumes summary, detailed facilities information and other relevant corporate, financial and technical information.

Download Non-Disclosure Agreement

To receive further information on the Property please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.